What are Accounts Receivable, and why do Small Businesses need it?

Why Accounts Receivable Matters to Small Businesses

Accounts Receivable (AR) might sound like a term reserved for accountants and financial gurus, but if you’re running a small business, it’s crucial to learn this concept. Why? Because AR is all about money owed to you, the funds that keep the engine of your business buzzing smoothly. Whether your company operates in the tech sector, healthcare, or construction, and you’re making between 300k to 3 million in annual revenue, this post is for you. We’ll dive into what AR is, its benefits, and how to leverage it for success. Ready? Let’s dig in.

What Are Accounts Receivable (AR)? Definition and Key Components

Definition and Explanation

Accounts Receivable refers to the outstanding balances customers owe to a company for goods or services provided on credit. It’s representing a vital part of your cash flow.

- Credit Sales: When you sell something and agree to get paid later, that’s a credit sale, and the amount due becomes part of your AR.

- Balance Sheet Item: AR appears on your balance sheet as a current asset. It’s money that you can reasonably expect to collect within a short period, typically within one year.

- Legal Obligation: Your customers must pay the amounts due within the agreed-upon terms.

So, if you’re offering payment terms to your customers, understanding AR isn’t just an option; it’s a necessity.

Key Components of AR

Here’s a breakdown of what makes up Accounts Receivable:

- Invoices: The bills sent to customers detailing the products or services provided, the amount due, and the payment deadline.

- Payment Terms: Outline the time frame the customer must pay the invoice, such as net 30 days.

- Credit Policies: The rules and guidelines define who can buy on credit and under what conditions.

- Collections Process: How you follow up with customers who need to arrive on time to pay.

With these components, you can manage the amounts owed to your business and ensure that cash keeps flowing.

Understanding AR: How AR Works and Its Importance in Cash Flow Management

How AR Works

Managing Accounts Receivable is about more than just waiting for payment. It’s a proactive process:

- You Provide Goods/Services: First, you offer your products or services to your customer on credit terms.

- You Invoice the Customer: You send a detailed invoice outlining what’s due and when.

- Customer Pays: Ideally, the customer pays within the agreed terms, such as 30 days.

- You Monitor and Manage: You keep track of all unpaid invoices, follow up as needed, and manage the entire cycle efficiently.

Accounts Receivable isn’t a “set and forget” aspect of your business. It requires continuous monitoring, efficient handling, and sometimes, a gentle nudge to the customers.

Importance in Cash Flow Management

Think of AR as a bridge to your cash flow. If managed correctly, it ensures that money’s always coming into your business. But if neglected, it can lead to cash shortages.

- Positive Impact: Prompt collections mean more operations, growth, and investment funds.

- Negative Impact: Delays in collections can result in cash flow bottlenecks, affecting your ability to meet obligations and grow.

Common Terms and Procedures

Understanding some standard AR terms and procedures can make this aspect of your financial management more straightforward:

- Days Sales Outstanding (DSO): Measures how long it takes, on average, to collect payment after a sale.

- Aging Report: Breaks down AR by how long invoices have been outstanding, helping identify potential collection issues.

- Collections Procedures: The steps you take to secure payment, ranging from gentle reminders to more assertive legal actions.

Benefits of AR: Enhancing Customer Relationships and Sales Growth

As a small business owner, you might wonder, “Why offer credit? Why not just get paid upfront?” While that sounds appealing, AR offers some strategic benefits:

- Enhances Customer Relationships: Credit terms can make you more attractive to customers, fostering trust and loyalty.

- Improves Cash Flow Management: With predictable payments, you can plan and manage your cash flow more efficiently.

- Facilitates Sales Growth: Credit terms may enable you to reach customers who wouldn’t buy otherwise, boosting sales.

But wait, it’s not just about the benefits. There are practical examples and insights on how to use AR effectively.

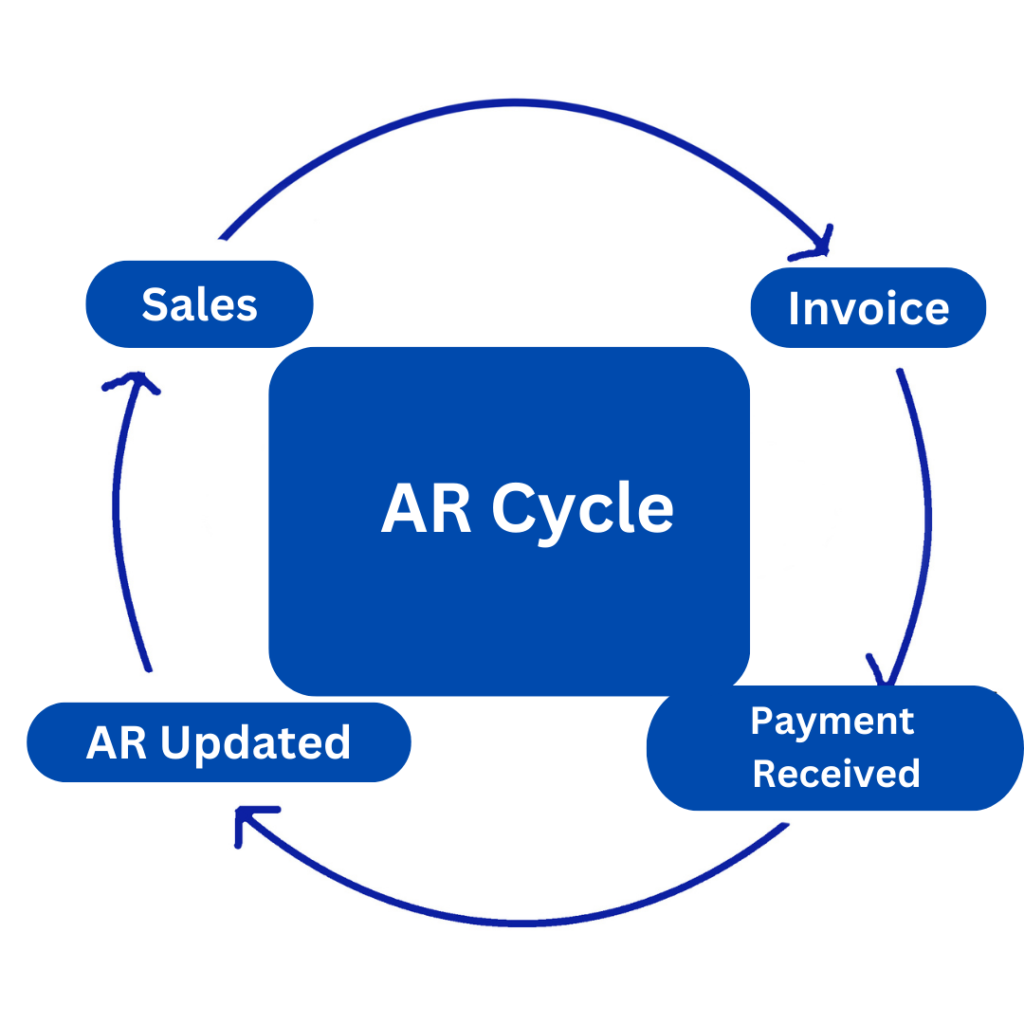

Example of Accounts Receivable: A Real-World Look at the AR Cycle

Understanding a concept is one thing; seeing it in action is another. Let’s explore a real-world example to see how Accounts Receivable works in the daily operations of a small business.

Meet SmallTech, a technology company making annual revenue from 700k to 3 million. They sell software solutions to other businesses and offer payment terms of net 30 days. Here’s how their AR process unfolds:

- Sale Made: SmallTech sells a software package to ClientCorp for $10,000 on credit.

- Invoice Sent: They send an invoice to ClientCorp, detailing the terms (net 30 days).

- Payment Received: ClientCorp pays the invoice 25 days after receiving it.

- AR Updated: SmallTech updates their Accounts Receivable records, removing the paid amount.

This simplified example demonstrates the AR cycle: a sale on credit, invoicing, payment, and updating records. Small businesses like SmallTech rely on AR to enhance cash flow and customer relationships.

How Businesses Use Accounts Receivable: Methods, Tools, and Best Practices

So how exactly do small businesses leverage Accounts Receivable? It’s not just about offering credit and waiting for payment. It’s about strategic management.

Different Methods of Using AR

- Offering Competitive Credit Terms: You can attract more customers by giving favorable terms.

- Managing Collections Efficiently: Effective collections procedures ensure that payments arrive on time.

- Using Tools and Software: Various software can automate AR management, minimizing manual effort and errors.

- Analyzing AR Data: Regular reviews of AR data provide insights into customer behavior, helping in decision-making.

Tools and Strategies for Effective AR Management

- Software Solutions: Utilizing software like QuickBooks can automate invoicing, reminders, and tracking.

- Clear Credit Policies: Having written credit policies helps in consistent decision-making and minimizes disputes.

- Regular Monitoring: Keeping an eye on AR aging reports helps identify potential collection issues early.

- Professional Collections Assistance: Sometimes, professional collections agencies can assist in recovering overdue amounts.

Best Practices

For small businesses wanting to maximize the benefits of Accounts Receivable, here are some best practices:

- Know Your Customers: Extending credit is a risk. Knowing your customers and their creditworthiness minimizes that risk.

- Set Clear Terms: Ambiguity can lead to disputes. Ensure that payment terms are crystal clear.

- Follow Up Proactively: Gentle reminders can sometimes nudge customers into paying sooner.

- Review and Adjust: Regularly review your AR processes, and make adjustments as needed. Stay agile and responsive.

Conclusion: Leveraging Accounts Receivable for Growth and Success

Accounts Receivable is more than a financial term; it’s a strategic asset for small businesses. By understanding what AR is, recognizing its benefits, and implementing best practices, you can turn this aspect of finance into a lever for growth.

Ready to dive deeper into managing your Accounts Receivable? Contact us today, and let’s explore how you can make AR work for your business.

Additional Resources: Further Reading and Learning Opportunities

Affiliate Disclosure: There are affiliate links on this page & if you click a link and make a purchase, I may receive compensation at no additional cost to you.